Stock Investing Account

Surprisingly simple

stock investing

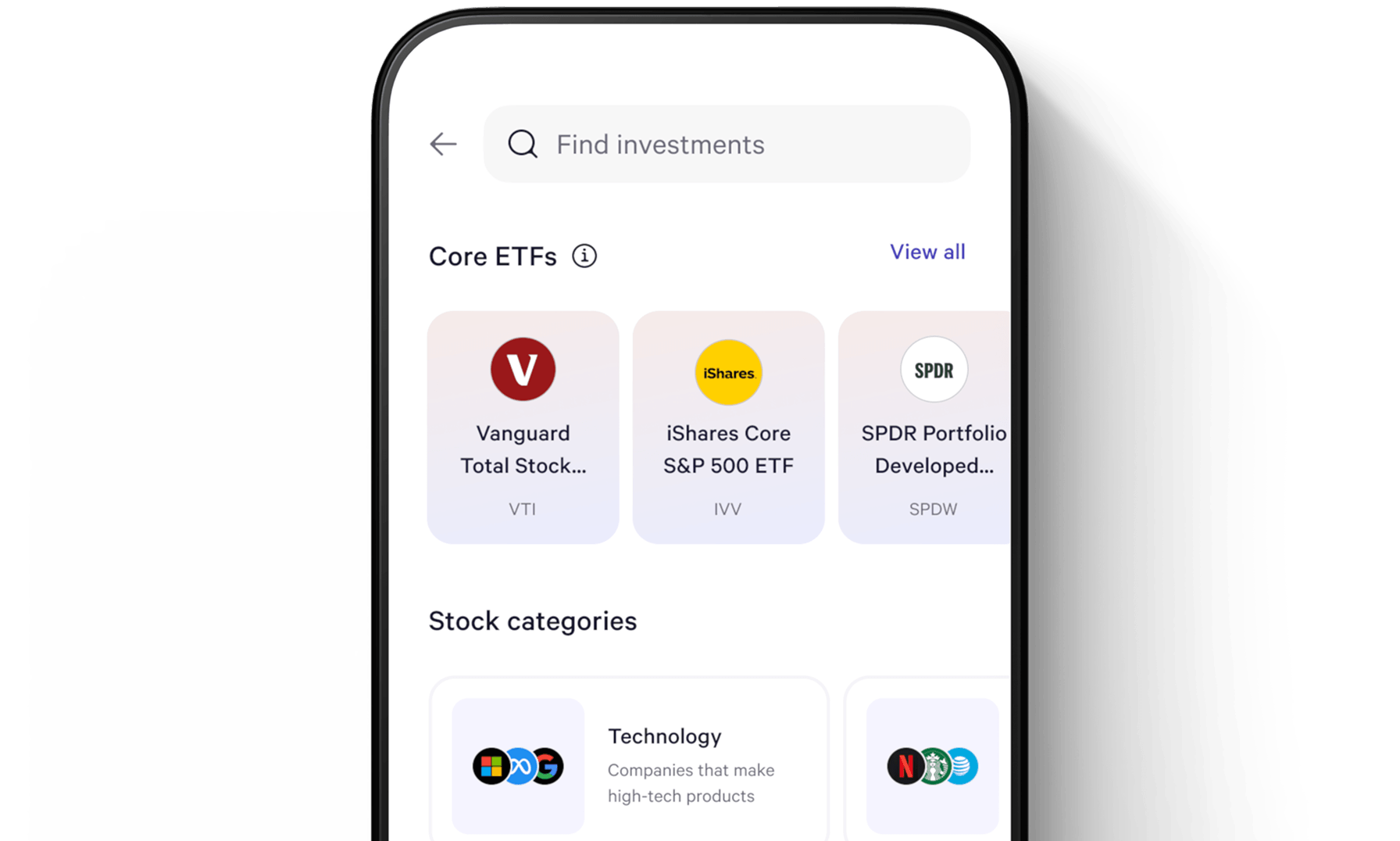

Built for long-term stock and ETF investing, not gambling

Simple by design—without distractions that encourage frequent trading

Zero commissions on trades and $1 to start investing

Securities shown are for illustrative purposes only, and are not a recommendation to buy or hold.

Securities shown are for illustrative purposes only, and are not a recommendation to buy or hold.

1.3M+

Trusted clients 2

$90B+

In client funds 2

Best Robo-advisor, Portfolio Options, 2022-251

Bankrate

Best Investing App, 2023-241

A place for investing,

not gambling

Many “free” trading apps are designed more like casinos than investing platforms.

They incentivize you to trade more often and they even earn more money when you make riskier trades (hint: it’s called PFOF). At Wealthfront, we don’t charge commissions or make money on your orders, so we don’t pressure you to make risky, short-term bets. Our main goal is to help you invest confidently for the long term.

Product images are for illustrative purposes only and are not recommendations. Chart data as of 01/21/26

Out with the noise, in with the ease

If you're investing for the long term, the last thing you need is an app that promotes frequent trading and encourages you to try riskier strategies like options, crypto, and prediction markets. With a Stock Investing Account, we've simplified the investing experience, making it easy to invest in stocks and ETFs in just a few taps. And with a Cash Account, your cash earns an industry leading 3.30% APY from program banks until you invest—you can move your money into the market in minutes or withdraw for free instantly, whenever you need it.

Product images are for illustrative purposes only and are not recommendations. Chart data as of 01/21/26

Some frequently asked questions

Still deciding if we’re right for you?

These frequently asked questions may help.