They grow up so fast. So can their college fund.

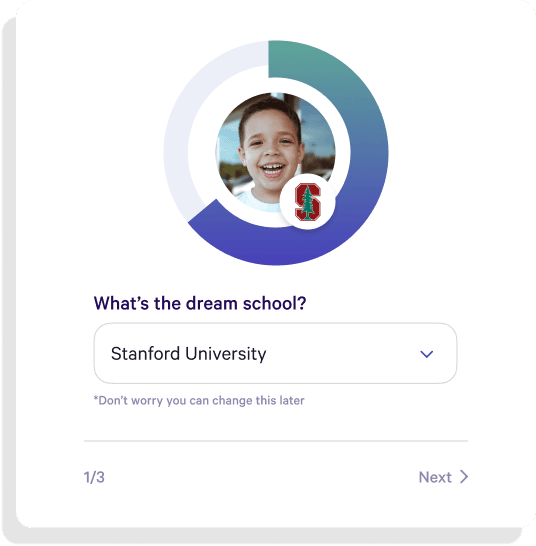

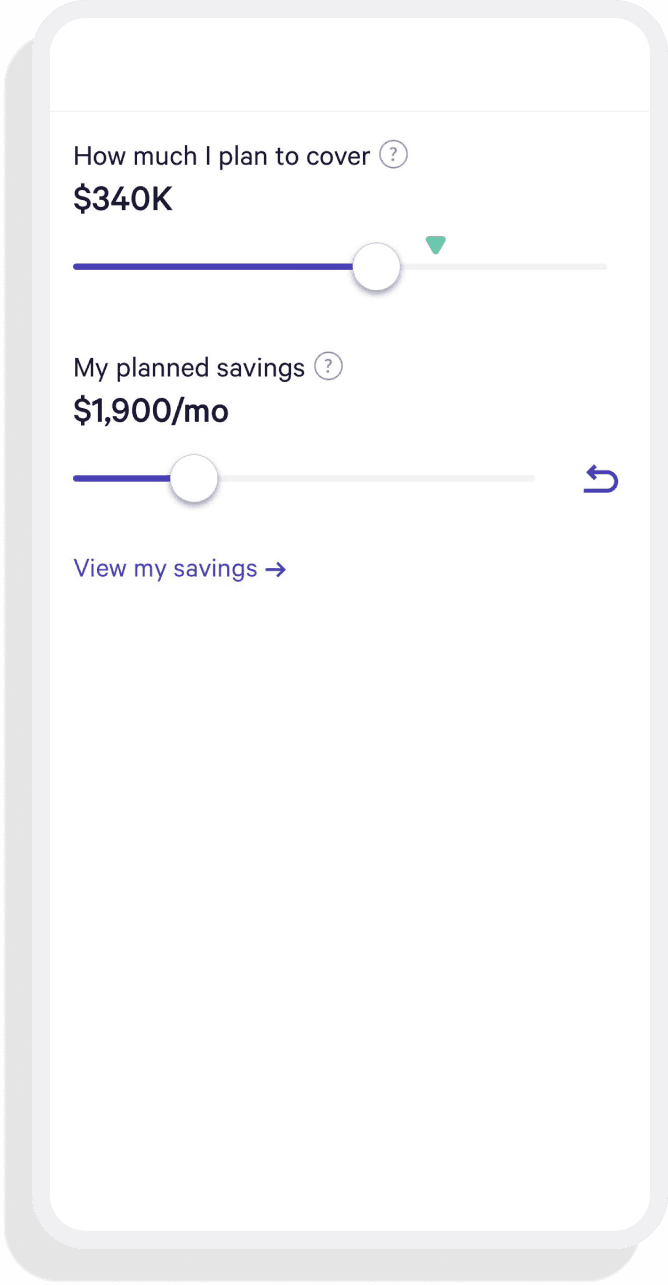

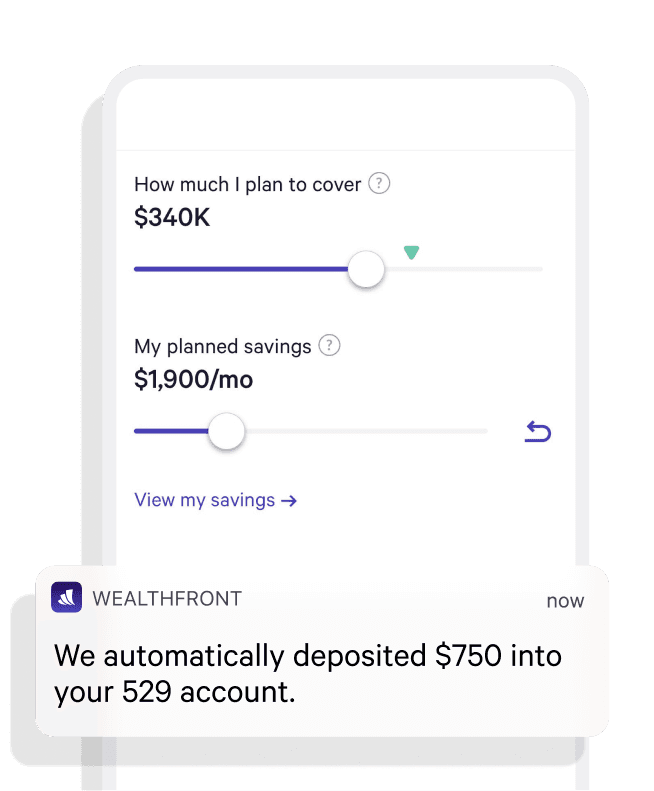

You don’t need to take Accounting 101 to start saving for your child’s future college. With a Wealthfront 529 account, your savings can grow tax-free while we manage the trades and automatically adjust your risk over time. We’ll even set you up with a personalized plan to help you budget for their dream school. And the sooner you start to save, the more you stand to earn. Which means less time stressing and more time helping with the homework.

Open an account